» THE INVEST IN LOMBARDY DATA 2012/2014

In addition to being a valuable partner for attracting foreign direct investments for initiating or developing business activities in Lombardy, Invest in Lombardy is also a privileged observer of the investment projects that have been proposed or implemented throughout the region, and is thus able to distinguish them by number, industry and economic importance.

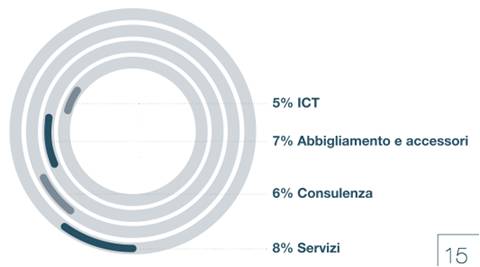

With regard to the projects in which it is involved, Invest in Lombardy elaborates systematic and insightful reports on the progress of its activities. Since 2012, for example, Invest in Lombardy has supported 369 foreign companies interested in investing in Lombardy, with projects in 42 different sectors ranging from ICT to Biotechnology, Medicine, Energy, Motor Vehicles, Clothing, and Consulting Services.

Main sectors by number of investment projects

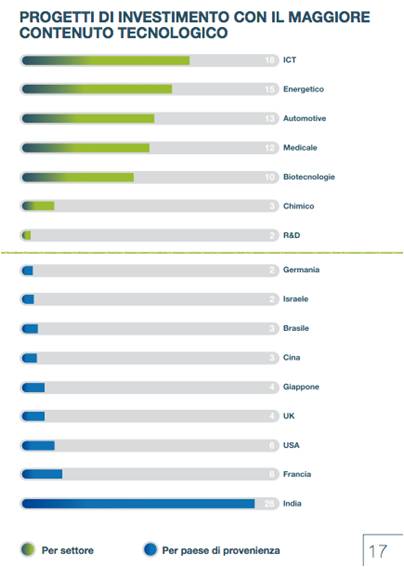

Investment projects with the greatest technological content

While the high geographical concentration of the investors is not surprising (over 70% of the investment projects originated with investors from 10 Countries), it is nevertheless interesting to note India's performance. In fact, thanks to the intense activity of a dedicated on-site desk, Invest in Lombardy received over 110 expressions of interest from this Country.

Number of expressions of investment interest by Country of origin

India……………… .111

France……….……. 34

UK…………….…… 29

China……….………… 22

Japan……….……….16

USA………….……. .14

Brazil …….………..13

South Korea………8

Netherlands……….……….8

Germany….…………7

Invest in Lombardy's work in the Far East is fully reflected in the words of one of the companies that has recently benefited from Invest in Lombardy's services:

The initial months of management weren't simple, as India's work culture is quite different. However, once we realized that it would be sufficient to enhance the existing work method, we began to see excellent results. We didn't choose Lombardy... it was Lombardy that chose us."

Atul Maheswari, Vimercati Spa

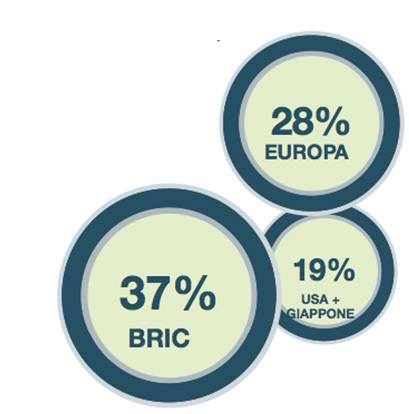

Lombardy has thus proven to be highly attractive for emerging countries: over the past two years, their flow of investments from the BRICs has reached over one third of the total. A slight increase has also been registered in Europe (28% of the total) and the U.S./Japan (19% of the total).